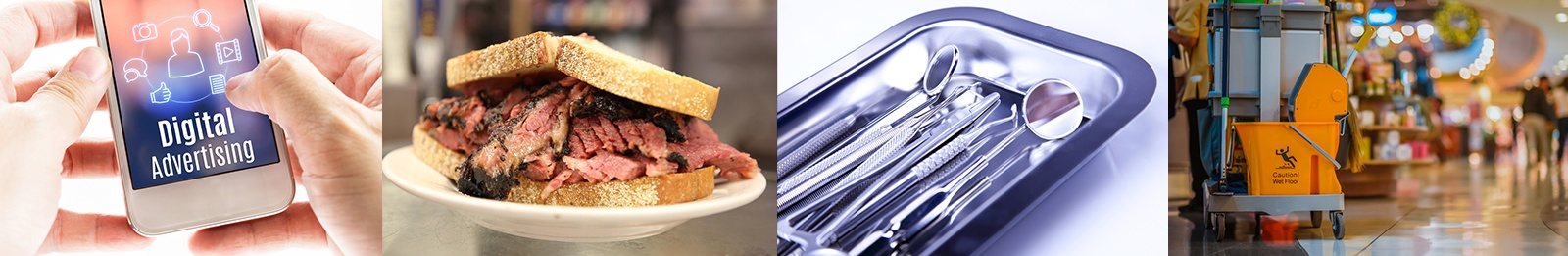

These are photos of some of the industries we have the privilege to serve.

Services

Chartered Professional Accountant in Toronto, ON

What we do

Colin Phillips, CPA Professional Corporation, is a business-focused tax and accounting firm that provides tax planning, business advisory, tax return and financial statement preparation, bookkeeping, and more. We also have extensive experience in the accounting and tax aspects of Estates, Trusts, and Private Foundations.

If you haven’t yet received your tax season package, one will arrive shortly. You can always find the tax season checklist on the resource page of our website. If you have any questions, we’re here to help.

Services We Offer

Business owners have to wear many different hats to run their companies well. But it can be challenging to get everything done and still have time to balance the books and keep track of all the expenses. We can help make sure the books are up-to-date, all required tax filings and payments are made on time, and all tax-saving measures are explored.

Colin Phillips, CPA Professional Corporation, understands that when it comes to your business, you need to know the exact state of your current financial situation. With an experienced staff that is dedicated to the efficient and accurate management of your business’s finances, you can rest easy knowing that the accounting aspects are properly taken care of. Here is a selection of services we provide: